What Are Crypto Narratives?

Narratives in cryptocurrency check with the trending concepts, tales, or beliefs that form how folks understand and worth cryptocurrencies. These narratives can affect investor sentiment, market tendencies, and the adoption of recent applied sciences.

Key Takeaways

Narratives in cryptocurrency check with the trending concepts, tales, or beliefs that form how folks understand and worth cryptocurrencies – they will affect investor sentiment, market tendencies, and the adoption of recent applied sciences.

Liquid restaking tokens, liquid staking derivatives, blockchain modularity, Layer 1s, Layer 2s (Optimistic rollups and nil information rollups), BRC-20, DePIN, DeSci, GambleFi, Telegram crypto buying and selling bots, and RWAs are some narratives to observe in 2024.

Crypto narratives can be deceptive and even dangerous based mostly on false assumptions or hype. Due to this fact, it is necessary to critically consider narratives and base your funding choices on sound evaluation and analysis.

This text was up to date in January 2024 to replicate new and upcoming narratives by the CoinGecko workforce.

Market contributors are all the time on the lookout for tendencies to higher perceive what’s happening, why it is happening, and its potential impacts. Traditionally, they use the dynamics of market cycles to behave extra proactively in future market environments. From Elon Musk’s tweets shifting the worth of DOGE, to believing within the Bitcoin halving driving bull runs each 4 years, many traders use crypto narratives to foretell worth motion.

For instance, the narrative of cryptocurrencies as a retailer of worth has attracted many traders who view cryptocurrencies as a hedge towards financial uncertainty. Equally, the narrative of blockchain as a disruptive expertise has attracted many entrepreneurs and builders working to construct new purposes on the blockchain.

Why Are Crypto Narratives Essential?

Crypto narratives emerge from a mixture of things, together with the technological capabilities of crypto and the blockchain, social and financial occasions, and the beliefs and motivations of the people concerned within the cryptocurrency trade. Mainstream media, social media, on-line boards, influencers, and market tendencies can gasoline narratives. In 2024, we’re seeing a pattern in narratives that discover the capabilities and utility of the blockchain, reminiscent of Decentralized Bodily Infrastructure Networks (DePIN) and Decentralized Science (DeSci).

Narratives are necessary as a result of they play a big function in shaping public notion and subsequently market actions. They supply a framework for folks to know the potential dangers and rewards of various kinds of cryptocurrencies, they usually can affect the trajectory of all the cryptocurrency trade.

Nevertheless, crypto narratives can be deceptive or dangerous based mostly on false assumptions or hype. As such, it is necessary to critically consider narratives and base your funding choices on sound evaluation and analysis.

Now, there are a number of rising tendencies and themes which might be making an attempt to outline 2024. We’ll have a look at the highest 11 crypto narratives to observe in 2024 on this information:

Liquid Restaking Tokens

Restaking is a rising narrative that focuses on capital effectivity, by enabling customers to stake the identical token and different protocols to safe a number of networks concurrently. This permits protocols to beat the challenges in constructing out their very own units of validators, whereas providing scalable safety based mostly on the person protocol’s wants. In trade, restakers take pleasure in an extra set of rewards based mostly on their restaking technique as they safe further protocols (though this comes with an extra set of slashing dangers).

EigenLayer is the pioneer within the restaking area, with over 3.5 million ETH in TVL at time of writing. Customers can restake their liquid staking tokens, reminiscent of stETH, rETH and cbETH, to safe Actively Validated Companies (AVSs) on EigenLayer.

Take a look at the highest liquid restaking tokens on CoinGecko.

Liquid Staking Derivatives

Liquid staking derivatives (LSDs) are cryptocurrencies issued by liquid staking platforms, permitting stakers a method to unlock their illiquid-staked belongings and generate extra yield. With commonplace staking, stakers safe proof-of-stake (PoS) blockchains by depositing belongings in a protocol. However this presents the difficulty of capital inefficiency as stakers miss the chance to generate further yield when their belongings are illiquid and locked up.

That is the place liquid staking is available in. The worth of the by-product asset is pegged to the underlying asset (locked when staked on a proof-of-stake blockchain), the place it continues to build up rewards and develop in worth with time. In the meantime, the by-product token can be utilized to have interaction in different DeFi actions like lending and offering liquidity. In return, most liquid staking suppliers take a share of 5-10% of the staking rewards as their income.

LSDs remedy capital inefficiency, decrease staking entry limitations, and enhance community safety and stability.

Take a look at the highest liquid staking tokens on CoinGecko.

Blockchain Modularity

Older blockchains like Bitcoin and Ethereum are monolithic, the place the blockchain performs all duties. Nevertheless, as the premise of competitors shifts from efficiency to price and suppleness, the modularity period begins. Modularization breaks down the blockchain into particular person parts, permitting the blockchains to scale past their present limits.

Execution: transaction execution

Settlement: decision/ fraud proofs/ bridge between different execution layers

Consensus: settlement on the order of transactions

Knowledge Availability: offering accessible knowledge for all community contributors

Execution takes place on Layer 2s like Optimism and Arbitrum, which execute and ship batched transactions to the mother or father chain. Even Layer 2s have gotten modular, as seen within the OP Stack, which modularizes all components of a Layer 2 chain into standardized open-source modules, which builders can use to construct new chains.

In the meantime, EigenDA is a decentralized knowledge availability layer constructed on Ethereum, and it’s at present utilized by Mantle, a Layer 2 chain to offer knowledge availability.

Layer 1s like Celestia are additionally adopting a modular structure to their blockchain. Within the case of Celestia, it focuses on consensus and knowledge availability, optimizing storage. This lets Layer 2s constructed on Celestia give attention to constructing the optimum execution setting for his or her purposes.

Layer 1s

Layer 1s are the basic base architectures upon which different blockchain purposes, like good contracts, are constructed. They carry out most on-chain transactions and act as public blockchains’ sources of reality. Conventional L1 blockchains, like Ethereum, are likely to expertise gradual transaction speeds, low scalability, and excessive fuel payment points. That is the place Layer 2 blockchains are available in, as they deal with the execution of transactions, leaving the L1 to give attention to issuing and verifying these transactions on the blockchain. Nevertheless, new L1 networks are altering the sport concerning transaction velocity, price, and interoperability.

Under are some examples of L1 initiatives to keep watch over because the Layer 1 narrative heats up:

Celestia

Celestia is the “first modular blockchain community to energy scalable, safe web3 apps.” It does this by “decoupling consensus from the execution layer,” the place Celestia fulfills the core perform of a consensus system, which is to order transactions and guarantee their availability, leaving executing and validating transactions to the shoppers that run on Celestia. Celestia goals to allow initiatives to seamlessly deploy their very own networks with out the necessity to bootstrap a brand new consensus. Furthermore, the undertaking has a formidable workforce led by Mustafa Al-Bassam, who has a Ph.D. in blockchain scaling.

Sui

Sui is a “boundless platform to construct wealthy and dynamic on-chain belongings from gaming to finance.” It is the primary permissionless L1 community designed from the underside to assist creators and builders create experiences that serve the upcoming billion customers in web3. Sui was established by a workforce of former Meta engineers working as Mysten Labs.

Sui scales horizontally with no higher restrict to fulfill utility demand whereas making certain cost-effective transaction prices. Moreover, it considerably improves scalability by facilitating parallel settlement on easy transactions, like minting and transferring a non-fungible token (NFT). Advanced transactions, like asset administration and DeFi purposes, are processed by Narwhal and Bullshark DAG-based mempool and Byzantine Fault Tolerant (BFT) consensus.

Layer 2s: Optimistic Rollups

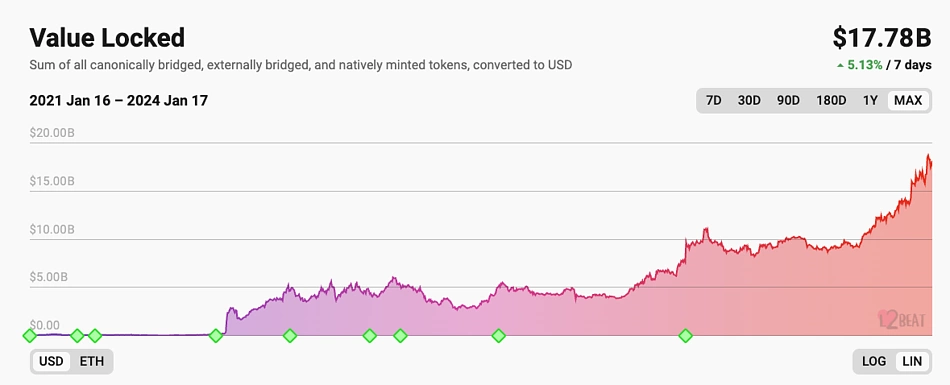

The vertical scaling narative is concentrated on Layer 2s, which are protocols constructed on prime of L1s to scale and develop them additional. They reduce computations of L1s by shifting transactions off-chain, considerably enhancing their throughput. L2s complete worth locked (TVL) has been steadily rising, snubbing the general DeFi market sentiments and the full cryptocurrency market capitalization.

Optimistic rollups are L2 scaling options that attempt to extend transaction throughput and decrease charges whereas sustaining the safety ensures of the underlying blockchains. They leverage a trust-based mannequin to verify transactions off-chain and add them to the underlying blockchain after being confirmed by a small group of “witnesses.”

Supply: Beat

Under are some L2 optimistic rollups initiatives to proceed watching in 2024 (sorted by TVL):

Arbitrum

Arbitrum is an L2 scaling resolution leveraging optimistic rollups to attain excessive throughput and decrease consumer transaction prices. Even after The Merge, Ethereum’s velocity and fuel charges are nonetheless excessive in comparison with different networks, like Arbitrum. This has led many web3 customers and creators to shift networks, inflicting Arbitrum’s TVL to hit highs of $3.2B in November 2021.

The latest ARB airdrop has injected a lot liquidity into the Arbitrum community. Many customers who acquired ARB tokens have been incentivized to make use of them to commerce, stake, or present liquidity on varied decentralized exchanges and protocols constructed on the Arbitrum community. The airdrop has additionally helped to extend consciousness of the Arbitrum community and its potential as an L2 scaling resolution for Ethereum.

Optimism

Optimism defines itself as a “quick, steady, and scalable L2 protocol developed by Ethereum builders, for Ethereum builders.” It is designed as a minimal extension to the present Ethereum blockchain to scale Ethereum purposes seamlessly. Not like the extra widespread EVM-compatible chains, Optimism is EVM-equivalent, which signifies that Optimism is in full compliance with the formal specs of the Ethereum blockchain, the place Optimism strikes in accordance with Ethereum. Optimism has additionally launched the OP Stack, which modularizes components of a Layer 2 chain in order that builders can construct new chains that interoperable with Optimism. In August 2022, Optimism noticed its TVL hit a high-time excessive of $1.15B, in keeping with Defillama.

Base

In February 2023, Coinbase launched Base, an L2 blockchain designed to serve tens of millions of upcoming web3 customers utilizing Optimism’s OP Stack. The community will present a safe, cost-effective, developer-friendly resolution for creators to construct web3 purposes. Moreover, Coinbase has created the Base Ecosystem Fund to assist Base startups.

Layer 2s: ZK Rollups

Zero information rollups (ZK rollups) are Layer 2 scaling options that enhance Layer 1 throughput by taking computation and state storage off-chain. This manner, they will course of quite a few transactions in batches and put up abstract knowledge on-chain. Zero information rollups help you show information of one thing with out revealing it. This makes them a beautiful resolution for purposes the place privateness is paramount, reminiscent of digital id verification and confidential transactions.

Listed here are examples of ZK rollups to be careful for in 2024:

zkSync Period

zkSync Period is one other L2 rollup that leverages zero-knowledge proofs to scale Ethereum with out sacrificing safety and decentralization features. It processes computations and shops most knowledge off-chain. Utilizing zkSync, you benefit from the Ethereum safety however at the next transaction velocity and decrease price.

Polygon zkEVM

Polygon has launched its zero-knowledge Ethereum virtual machine (zkEVM) Mainnet Beta on March 27, 2023, which is a giant step in the direction of scaling Ethereum and reaching mainstream web3 adoption. Like Optimism, the Polygon zkEVM is EVM-equivalent, which signifies that most Ethereum-native purposes can perform on the zkEVM and builders don’t want to change or reimplement code.

Scroll

Scroll is an L2 resolution striving to supply limitless scalability, excessive throughput, full decentralization, and trust-minimal privateness. It goals to attain this by leveraging ZK rollup and high-performance off-chain decentralized techniques.

Taiko

Taiko is a zero-knowledge Layer 2 is designed to be probably the most Ethereum-equivalent ZK-rollup, offering dApps a scalable and environment friendly platform with out having to make any adjustments to their present protocol. Not like many different zero-knowledge Layer 2s, Taiko is concentrated on reaching full compatibility with Ethereum over the velocity of ZK-proof technology, which allows the reuse of execution shoppers with minimal changes. To check out Taiko, you possibly can take part of their protocol usability exams on their testnet.

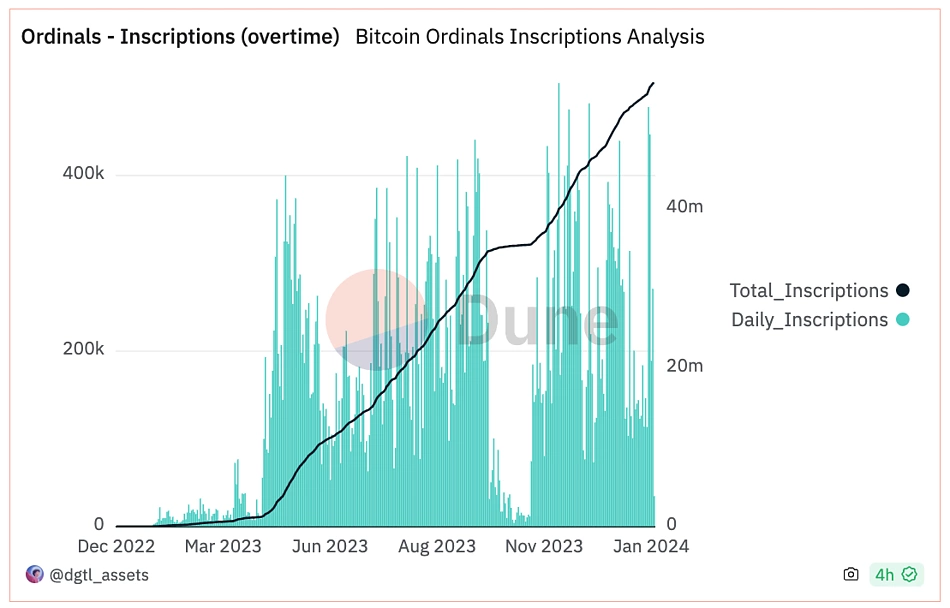

Bitcoin: Ordinals and BRC-20 Tokens

Ordinals are among the many newest tendencies taking Bitcoin by storm. In January 2023, software program engineer Casey Rodarmor deployed the Ordinals protocol on the Bitcoin blockchain, enabling NFT minting on the mainnet. The transfer spiked blended reactions from the Bitcoin group. Some noticed the transfer as a menace to the Bitcoin blockchain, whereas others have been excited and began crafting Inscriptions – Bitcoin’s model of NFTs.

Similar to NFTs, Ordinal Inscriptions are digital belongings inscribed on a Satoshi, the smallest denomination of a BTC. Nevertheless, not like an NFT which makes use of a decentralized file storage system, Ordinals are straight saved on-chain. The inscriptions are made doable by the Taproot upgrade launched into the Bitcoin blockchain in November 2021.

The quantity and order of BTC Ordinals have been intently monitored, and there are some noteworthy collections and high-priced gross sales made thus far. They embrace Ordinal Punks, Taproot Wizards, Bitcoin Rocks, Timechain Collectibles, Ordinal Loops, Ripcashe’s Energy Supply, Bitcoin Shrooms, The Shadow Hats, The Dan Information, and Toruses.

Thus far, there are nearly 55.8 million Ordinal inscriptions on the Bitcoin blockchain.

Supply: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

Past Ordinals, there has additionally been an curiosity in BRC-20 tokens, which makes use of ordinal inscriptions to allow the minting and switch of fungible tokens on the Bitcoin blockchain. BRC-20 tokens are just like the ERC-20 token commonplace on Ethereum and EVM networks. BRC-20 tokens are minted by the group, the place Ordinal wallets can freely mint BRC-20 tokens as soon as they’re deployed. Whereas nonetheless within the early levels, there are platforms that allow the decentralized minting and buying and selling of BRC-20 tokens.

There was a surge in curiosity in BRC-20 tokens in December 2023, resulting in a excessive of over $27 common transaction payment in December 2023.

Decentralized Bodily Infrastructure Networks (DePIN)

DePIN refers to decentralized bodily infrastructure networks, which use blockchains and token rewards to develop infrastructure within the bodily world throughout totally different fields, reminiscent of wi-fi connectivity, geospatial mapping, mobility, well being, vitality, and extra.

The purpose of DePIN is to create resource-efficient bodily infrastructure by incentivizing suppliers to commit their bodily sources to a decentralized community. The DePIN then makes these sources accessible to customers who’re on the lookout for cheaper service fees (relative to centralized amenities), and the community generates income by charges paid by the customers.

Take a look at the highest DePIN tokens on CoinGecko.

Decentralized Science (DeSci)

DeSci refers to decentralized science, which makes use of blockchain expertise and its options to make varied features of scientific analysis and collaboration extra open, incentivized, and group pushed. DeSci goals to beat the ‘valley of dying’ in scientific analysis, the place it takes time to develop and translate scientific analysis into improvements that profit sufferers.

Decentralized science is concentrated on enhancing the next areas: knowledge sharing, analysis and publishing, and funding. It does this by incentivizing customers with tokens, using NFTs that can be utilized as a key to the underlying undertaking, and DAOs which may distribute funds and management processes.

Take a look at the highest DeSci tokens on CoinGecko.

GambleFi

GambleFi refers to decentralized purposes that present crypto-based betting providers. These purposes are bringing on-line playing on-chain to enhance the consumer expertise, specializing in transparency and equity. Furthermore, in GambleFi, customers can now stand on the identical aspect as the home, as they will maintain the protocol’s tokens and revenue from the protocol’s generated income.

The GambleFi narrative took off throughout the bear market, and it is going to be attention-grabbing to see the way it develops when the bull market comes.

Take a look at the highest GambleFi tokens on CoinGecko

Actual World Property

Actual World Property (RWAs) are belongings present within the bodily world or off-chain however are tokenized and transferred on-chain to behave as a supply of yield in DeFi. These embrace actual property, treasured metals, commodities, and artwork. RWAs are a core aspect of the worldwide monetary system; in 2020, for instance, international actual property was valued at $326.5T whereas the gold market cap stood at $12.39 T. A rising portion of RWAs are centered on the leveraging US Treasury Payments and excessive rates of interest as a strategy to provide traders lower-risk yields, together with firms reminiscent of Ondo Finance.

MakerDAO has additionally entered the RWA area by deploying idle belongings into short-term bonds, utilizing the proceeds to ramp up an MKR buyback program and bolster the DAI Financial savings Price, offering a transparent instance of how protocols may benefit from RWA investments. MakerDAO exhibits how worth can circulation to token holders, the place the buyback program is driving progress of MakerDAO.

The potential impression that RWAs can have on DeFi appears enormous:

They’ll present a supply of sustainable and dependable yield to DeFi, as they’re backed by conventional belongings.

They may help DeFi to develop into extra appropriate with the standard monetary markets, making certain extra liquidity, capital effectivity, and funding alternatives.

They’ll bridge the hole between DeFi and conventional finance (TradFi).

Maple Finance (MPL), Goldfinch (GFI), and Centrifuge (CFG) are different examples of RWAs that concentrate on RWA lending that you possibly can take a look at.

Take a look at the highest RWA tokens on CoinGecko

Telegram Buying and selling Bots

In 2023, there was additionally an increase in Telegram crypto buying and selling bots that provide customers comfort and effectivity with regards to executing trades. As an alternative of needing a pc to attach your pockets and approve transactions, all customers have to do to purchase tokes is to repeat and paste the token’s contract tackle and ship it as a chat to purchase the token. This additionally quickens the promoting course of, as you possibly can pre-approve and signal transactions.

Some Telegram buying and selling bots additionally include further options like multi-wallet sniping that bypasses particular person pockets restrictions on tokens, and liquidity sniping that executes a purchase order as soon as the bot detects liquidity being added to maximise features on a brand new token.

Be taught extra in regards to the totally different Telegram crypto buying and selling bots and their options in our article on the High 5 Telegram Buying and selling Bots.

Take a look at the highest Telegram apps tokens on CoinGecko.

Conclusion

In 2023, we noticed narratives like Synthetic Intelligence, Chinese language tokens, and decentralized social media, alongside different narratives like Layer 1s, Layer 2s, liquid staking derivatives, real-world belongings, and Bitcoin Ordinals and BRC-20. Shifting into 2024, there are new rising narratives like restaking, DePIN, DeSci, GambleFi, together with an curiosity in blockchain modularity.

Keep in mind, this text is just for academic functions and shouldn’t be taken as monetary recommendation. Please do your personal analysis (DYOR) earlier than investing in any asset.

#Crypto #Narratives #High #Narratives #UPDATED

Read full Article